Semi-Automation Effort

I am semi-automating my philanthropy to exemplify the purpose of my Trust and ‘walk the talk’. In early 2025 I finished two software suites as part of this plan. Those software suites are open source and freely accessible via GitHub (click here to be taken to my GitHub repository). At GitHub is a README.md file which has also been copied to this website. A narrative summary of the software follows.IRS Form 990s

My Excel VBA program scores IRS Form 990s with an algorithm inspired by the Piotroski F-Score. To reproduce what I did:-

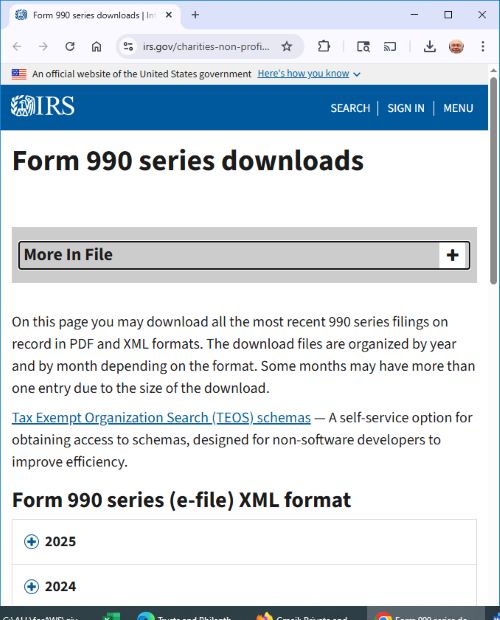

Download and unzip the IRS Form 990s (which must be submitted by 501c3 entities annually).

IRS website that offers all filed Form 990s. - Run the Excel VBA program, called Parse, that reads each Form 990. You can specify desired attributes to extract, but my default is 30 attributes. The program stores in an Excel worksheet one row per 501c3 and 30 columns for the 30 attribute values. For the year 2024 this leads to 360,000 rows (the IRS has more 990s, but my program excludes some, such as 990-EZ).

- Run the VBA program called Score that reads a text file specifying 16 rules and applies the rules to each 501c3. Each rule produces a 1 or a 0 for each of the 16 rules for each of the 360,000 501c3s. For any given 501c3, the maximum score is 16 and minimum is 0. The rules have a simple syntax and semantics that is described in the GitHub README, and you can modify the rules to create your own scoring criteria.

- For each 16-point 501c3, determine its conditions for a named, endowed, targeted award.

- With the most appropriate 501c3s, negotiate agreements for a donation.

My efforts are small compared to those of the 501c3 evaluator giants of Charity Navigator, GuideStar, Give.org, and GreatNonprofits, but my results are free, open source, and designed for a donor to tailor to his fit.

Labor Department Scholarship Directory

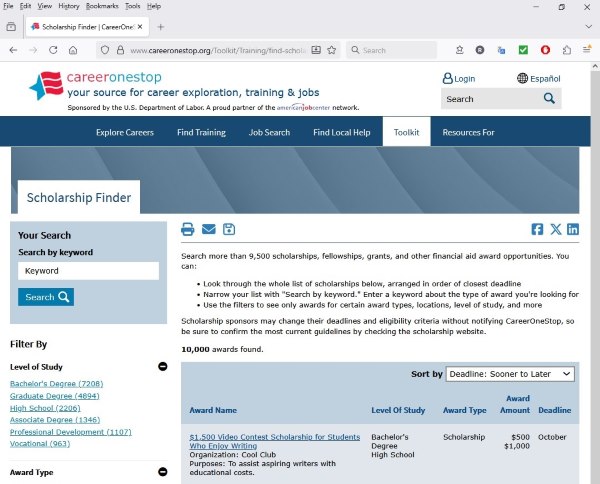

The US Labor Department maintains a directory of scholarships which includes 100,000+ scholarships. I wrote a Python program to- extract 8 attributes of each scholarship and

- determine the number of scholarships of every organization in the directory.

- study the entities which award the most scholarships,

- identify the most suitable for my purposes, and

- enter into negotiations for donations.

Next Steps

The next steps are- bring the Form 990 and Scholarship parts together,

- semi-automate the obtaining of further information about attractive entities, and

- semi-automate the negotiation of Agreements for donations.